States Struggle to Replace Lost Revenue from Gasoline Taxes

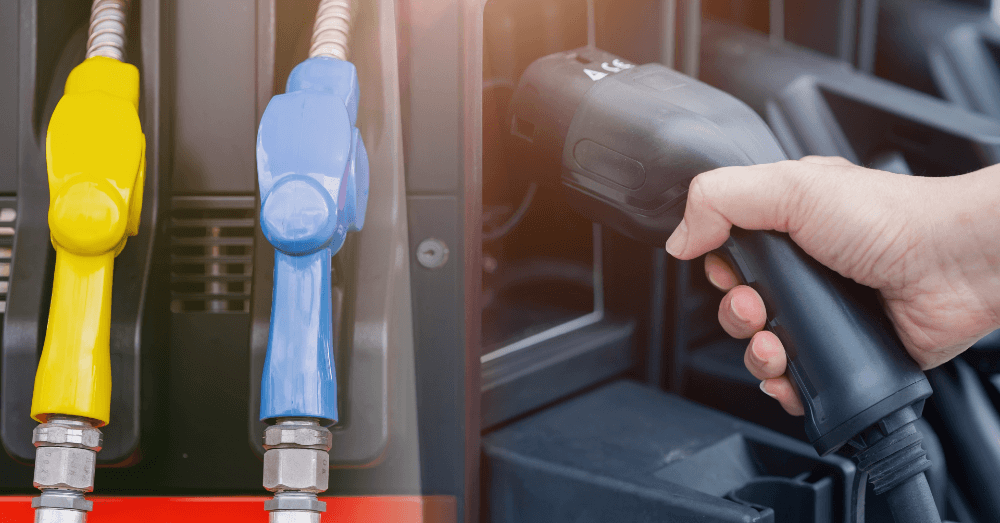

The movement away from gasoline-powered vehicles and toward electric vehicles is creating an issue with the vehicle fuel tax that most states receive.

When you fill up at the pump, part of the price you pay is a gas tax applied by the state. This money goes into a fund to care for the roads and transportation infrastructure in your state. Unfortunately, electric vehicles are disrupting the flow of this revenue, which could be problematic if states don’t find ways to collect a tax on electric vehicles and the energy used to fuel them.

Public chargers will be easy

The growing number of public EV chargers can easily be taxed, and that can offset some of the losses that states feel in terms of the transportation funds. Each public charger is used and charges the user a fee to plug in and refill their batteries. The challenge isn’t at these chargers but at the chargers used in a home. Many EV owners have Level 2 charging plugs in their homes and use them for overnight charging. It would be extremely complicated for states to collect taxes from utility companies on the monthly electric bill.

Many electric vehicle mandates

Most of us are familiar with the EV mandate of 50% of total sales in America by 2030, but other countries are even more aggressive with their plans to change to EVs and alternative fuel vehicles. Most countries in the European Union will have 100% electric vehicles or zero-emission vehicles by 2050, but some are even more aggressive.

Some of the more aggressive countries are:

- Norway: Plans to phase out ICE vehicle sales by 2025

- Iceland:Banning the new registration of diesel and gasoline vehicles after 2030

- United Kingdom: Moving to zero-emission vehicles by 2035. This mandate requires 80% of new cars and 70% of new vans to be ZEV models by 2030 and 100% of them to be ZEV models by 2035.

How can states recover vehicle fuel tax revenue lost

Unfortunately for drivers of gas and diesel-powered vehicles, many states have increased the fuel tax on gas and diesel to offset the losses experienced. The more electric vehicles hit the market, the higher these taxes are likely to go, unless states find ways to regain some or all of the revenue lost. Roads must still be maintained and built, which means this money is necessary.

Many states have already produced ways to charge EV owners additional fees and taxes to help offset some of the revenue lost. Unfortunately, some of these taxes are one-time fees, while the vehicle fuel tax on gasoline and diesel is paid every time a pump is used.

- Kentucky passed a new excise tax on electric power to charge EVs starting January 1, 2024.

- Washington, D.C. is considering removing the excise tax exemption for EVs.

- Utah passed House Bill 301, which taxes vehicles based on weight, which means EVs will be taxed higher because they are generally much heavier than their gas-powered counterparts.

- Some states are charging an additional registration fee for EVs. These states include California, Michigan, Texas, Washington, and Wyoming.

Some states charge vehicle miles traveled tax

The vehicle miles traveled tax (VMT) is charged in some states, which could also offset some of the revenue lost to EVs. This fee is permanent in some states, and vehicles registered in that state must have the odometer readings reported to calculate the tax. In Oregon, this tax is 1.8 cents per mile, and Washington charges 2.5 seconds per mile. Other states with a VMT are Hawaii, Utah, and Virginia.

Will added taxes change some minds?

Electric vehicles are a new and growing part of the automotive world, but many states are looking for ways to reclaim the revenue lost to EVs that would have been captured through the vehicle fuel tax. Some states have found ways to do this, while others haven’t done much yet. Will this change the minds of some drivers who are considering the change from gas to electric for their next ride?

This post may contain affiliate links. Meaning a commission is given should you decide to make a purchase through these links, at no cost to you. All products shown are researched and tested to give an accurate review for you.